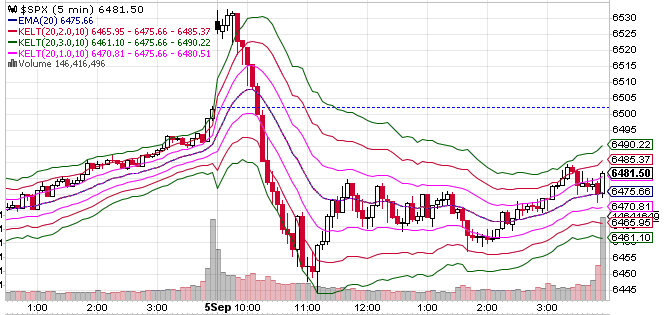

The market was up slightly for the week, but that is not what is the most interesting. On Friday, the market gapped up, took a dive after the open and then regained some of the losses by the end of the day.

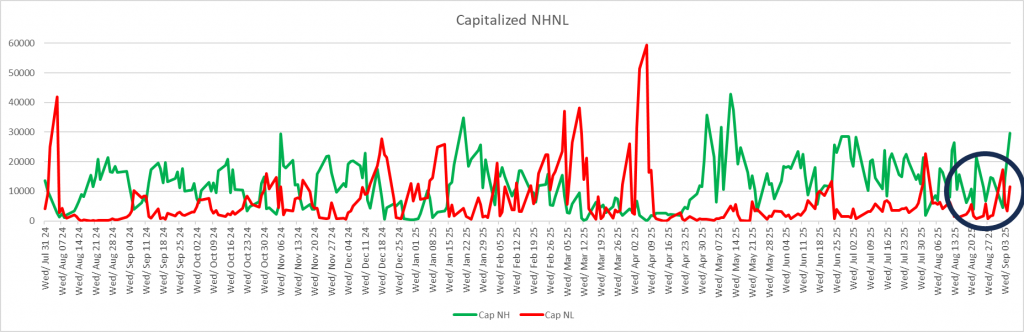

New highs shot up, new lows shrank, but the interesting part is the capitalized highs and lows. New highs shot up to 30 trillion, but new lows exceeded 10 trillion. The S&P 500 is incredibly top heavy at the moment and the capitalized new lows have been building over the last couple weeks. It is unusual for the capitalized new lows to exceed 10 trillion when the capitalized new highs are that high. It is something to keep an eye on. Will that build continue or be shrugged off?

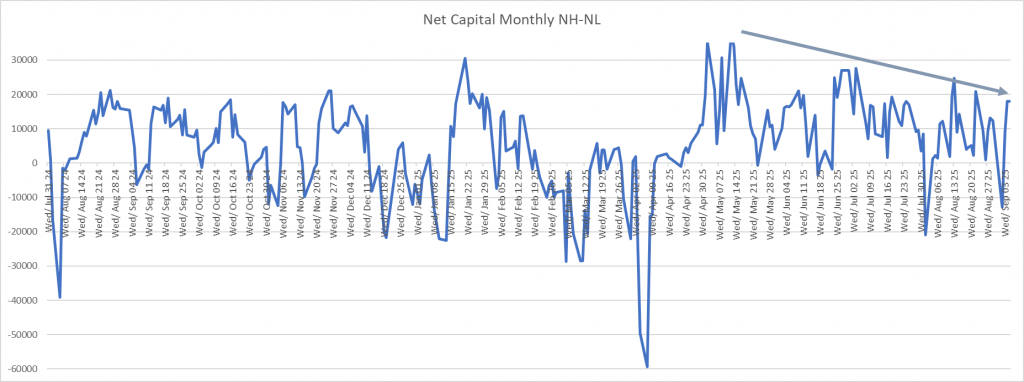

The net capitalized NH-NL still shows a bearish divergence and the 52 week NH/NL continues to not show much strength.

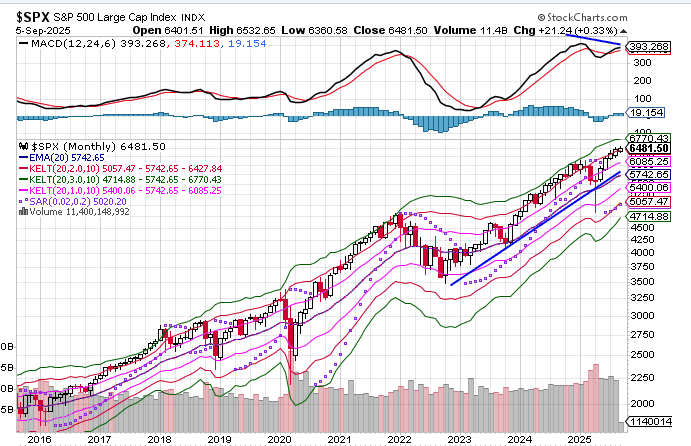

Market tops take a lot longer to form than bottoms. Are we close to a top or is this just a consolidation for the next move higher? We are still stuck in a tight range with not a lot of volatility. One final thing to consider, there is a MACD bearish divergence forming on the monthly chart. That is interesting and something to pay attention to!