We continue to make all time highs, I took profits and sold some losers last week. My win rate for the year is still hovering around 70%. I left a few trades going, but I am not enthusiastic about them. I don’t think I have been fully in the market since April. However, risk management has been good and my return has been incredibly healthy this year. For fun, I tested a couple shorts this week with mixed results.

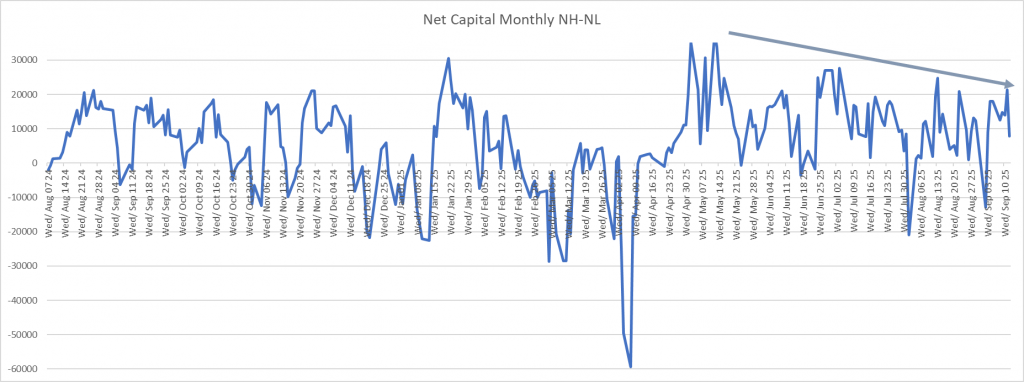

As the market moves higher, all the warning signs of a pullback are still there. The Net Capitalized NH-NL is still showing a bearish divergence.

So is the 52 week NH/NL. I think this is the source for most of my skepticism. I believe what these charts tell me the most.

At least a minor pull back this week would not surprise me at all. That has a tenancy to happen when the capitalized new highs hit 30 trillion. Of course, I would prefer a healthier pullback. It would be nice to get at least one more greedy bullish push before the year ends. That has a better chance of happening with a little more volatility and a healthy 5-10% pullback. I will take what the market gives me. It will be interesting what actually does happen!