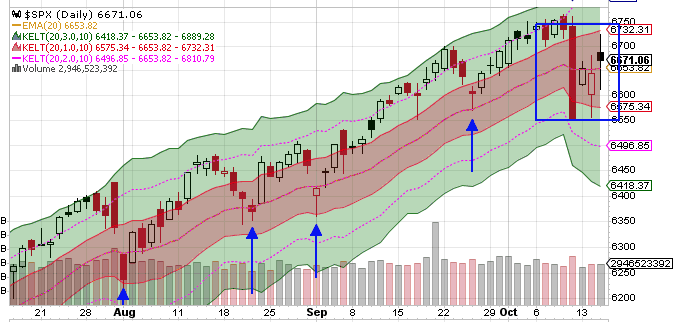

The market moved up for the first hour and then reversed for most of the day before gaining back some of the loses, but still closed below the open.

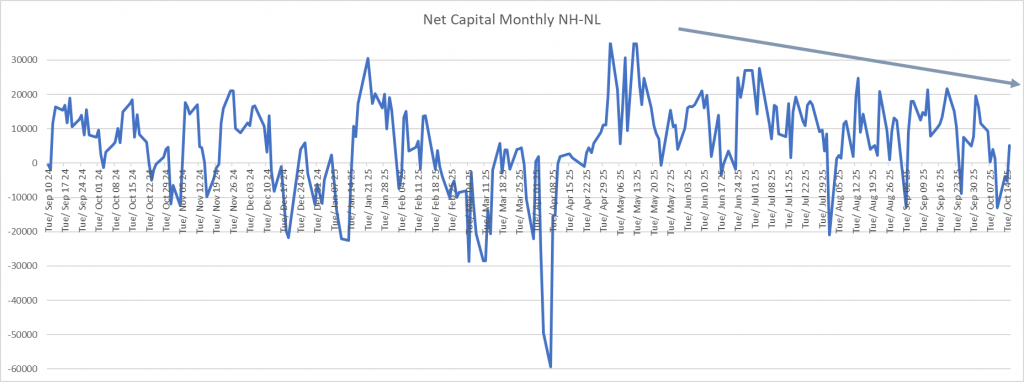

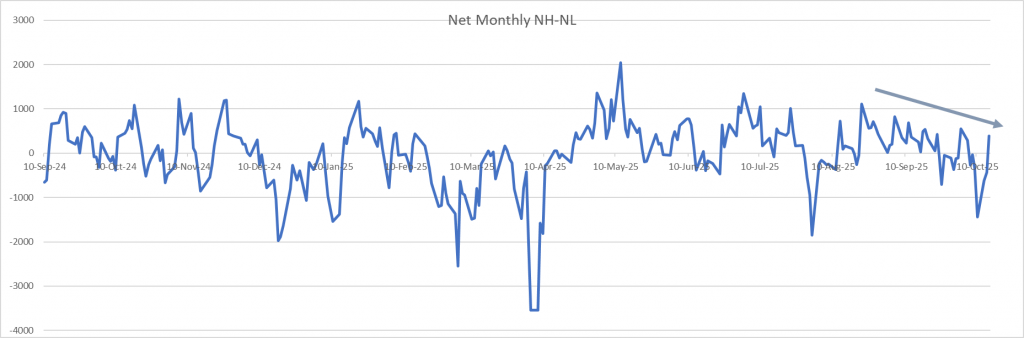

Both the NHNL and Capitalized NHNL are now positive. Normally, I would have reentered the market this afternoon, but the price action did not give me a lot of confidence. There were a couple attractive stocks, but I stayed on the sideline. The market is sitting in its value zone and this reversal has not behaved the way the passed ones have. Since April, we have seen the market bounce after a brief pullback and keep going. That has not happened in the same orderly manner this time. I am happy to stay on the sideline until there is more clarity.

The day trading shorting strategy I have been testing continues to perform very well. Yesterday was not great, but Monday and Today were really good. Unless something changes, I will add more money to the trades on Friday. I have made one small tweak to my entries that seems to be improving the results. My win rate has not changed, but the return per trade has improved. The new swing trading strategy I am testing is also showing promise. I am trying two different variations to see which one works and better fits with how I like to trade. I am confident one of them will work out and be useful. Not sure which one.

Earnings season is starting and it will give me a better idea of how aggressive to be going forward.

It still makes sense to be cautious.